We really enjoyed working with Veritax Advisors; they provided us with significant value. We particularly appreciated that they inspected our property to get first-hand evidence of equipment and infrastructure.

Meet The Team

We’re a boutique specialty tax firm that’s laser-focused on client satisfaction.

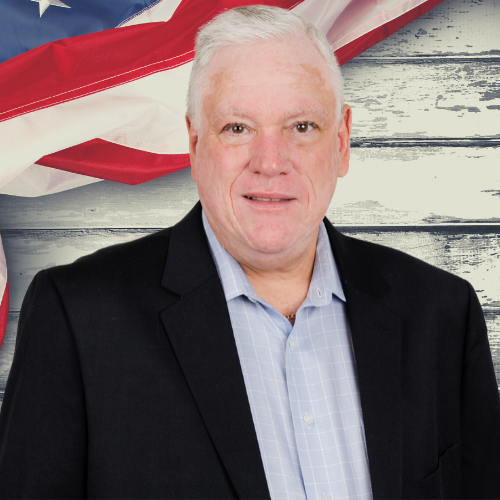

A. Chris Ostler, CPA

FOUNDER, CEO A. Chris Ostler is a highly accomplished leader in the field of accounting and specialty tax services. As the Founder and CEO of our firm, he leverages his extensive experience and expertise to drive innovative solutions for our clients.Chris is a licensed Certified Public Accountant in Nevada, holding this credential since 1996. With a specialization in specialty tax services since 2005, he brings a wealth of knowledge to his role. A former Deloitte consultant, Chris has cultivated deep expertise in cost segregation and fixed asset issues, positioning him as a leading authority in the field.

His diverse professional background includes experience at a Fortune 500 company as well as in start-up environments, enhancing his strategic insight into various business landscapes. Chris is also a dedicated member of the American Institute of Certified Public Accountants.

On a personal note, Chris is fluent in Brazilian Portuguese and possesses proficiency in French, Spanish, and Italian. He resides in Southern Utah with his wife, Michelle.

Katie Fenton

ADMINISTRATIVE ASSISTANT Katie has been with Veritax Advisors since the beginning of 2024, bringing valuable organizational expertise and a strong willingness to learn. She plays a pivotal role in preparing client estimates, managing contracts and invoicing, and coordinating pre-study setups.Prior to joining our team, Katie accumulated eight years of experience in the customer service and yard management sectors, where she held leadership positions, built strong relationships with her customer base, and earned a chainsaw certification.

During her high school years, Katie was honored with the John Philip Sousa Band Award, showcasing her talent as a performer across various ensembles, including marching, pep, concert, and jazz bands.

Outside of work, Katie enjoys quality time with her husband and son, exploring new recipes from around the world, and traveling to visit family across the country. These experiences enhance her professional skills and provide her with a broader perspective on diverse regions of our country.

Heather Holcomb

HEAD OF ADMINISTATION Heather has been with Veritax Advisors since 2022, bringing a strong background in operations administration, technical skills, and financial management. She plays a crucial role in managing the engineering aspects of cost segregation and in designing and overseeing project workflows.Prior to joining us, Heather worked with a non-profit organization where she managed day-to-day operations and oversaw financial and production processes. She was instrumental in the publication of several books, provided extensive technical support, transcribed materials, maintained donor records, and handled various data entry tasks. With over 12 years of experience in project management, client relations, research and development, technical support, and finance, Heather brings a wealth of expertise to our team.

Outside of work, Heather enjoys spending time outdoors, reading educational literature, and cherishing moments with her family, all of which enhance her professional skill set.

Dave Clark

SENIOR ACCOUNT EXECUTIVE Dave Clark is a Senior Account Executive at Veritax Advisors, bringing over a decade of experience in the tax and accounting industry. With a strong emphasis on tax planning and strategies, Dave is dedicated to helping clients optimize their tax savings and navigate complex financial landscapes.Passionate about utilizing his expertise to make a positive impact, Dave thrives on guiding individuals and businesses to achieve their financial goals. His commitment to client success is matched only by his enthusiasm for building lasting relationships.

Outside of work, Dave enjoys cycling, traveling with his wife, and hiking with their dog. He believes that maintaining a balanced lifestyle is essential, and he often finds inspiration for his professional pursuits during his outdoor adventures.

Mike Sloan

SPECIALTY TAX CONSULTANT Mike joined Veritax Advisors in September 2024 bringing with him his 30 plus years of experience in working with a team of financial specialists to help business owners protect and grow their wealth in the most tax efficient manner possible.Mike lives in Clermont, FL and serves clients across the United States.

For recreation Mike enjoys traveling, nature and wildlife photography, hiking, fishing, and metal detecting on Florida’s famous beaches, searching for Spanish Treasure.

If you would like to schedule a call with Mike visit:TalkwithMike.info

Kevin Miller

SPECIALTY TAX CONSULTANT With nearly two decades of experience as a trusted advisor to real estate investors and owners, Kevin brings a wealth of expertise to our team. After 13 years in the commercial title and escrow industry, he identified an opportunity to help his clients significantly reduce their tax liabilities through an IRS-approved strategy known as Cost Segregation.Kevin's background uniquely positions him to analyze and advise on various types of investment real estate, allowing him to pinpoint opportunities for tax relief.

Outside of work, Kevin enjoys golfing, motorcycle touring, and spending time by the poolside, where he loves barbecuing for family and friends.

Preet Sekhon

HEAD OF BUSINESS DEVELOPMENT Preet Sekhon believes that navigating the complexities of the tax code should not hinder a business’s ability to thrive. As the Head of Business Development at Veritax Advisors, he is committed to making specialty tax consulting accessible and beneficial for every client. With a focus on clear communication and personalized strategies, Preet empowers businesses to achieve their financial goals through informed tax planning.In 2020, Preet was diagnosed with early-onset Parkinson’s disease. Since then, he has become an advocate for outreach and fundraising efforts, using his platform to raise awareness and support for the Parkinson’s community. Through both his professional and personal endeavors, Preet continues to prioritize connection and service, dedicated to supporting his guests and the causes that matter most to him.

Craig Peterson

ENGINEER Craig has been with Veritax Advisors since 2024, contributing his expertise in building component identification and classification, construction techniques, and technical skills. He plays a vital role in the engineering processes, project setups, data acquisition, and departmental support.Prior to joining us, Craig amassed over 20 years of experience in the construction and renovation industries, where he developed innovative solutions for unique challenges and provided extra attention to important details that were often overlooked. He also managed projects to ensure successful completion and customer satisfaction.

Outside of work, Craig enjoys hiking and spending time outdoors, helping others, designing and creating various construction-related projects, and pursuing continuous learning, all of which enhance his professional skills.

Our Mission at Veritax Advisors LLC

Our name is our motto, and we live by one simple principle—we do what we say we will do!

Your Partner in Taxes

We help CPA firms add revenue without adding more burden to their team.

A Trusted Advisor

We're honest and open with our clients and everyone we work with.

Specialty Knowledge

Our founder is a CPA with 25+ years of experience in taxes and reducing taxes.

What Our Clients Say

Luca Sartori

Erik Vasquez

Chris and his team went above and beyond to ensure we got the project done correctly. Just started another one with them. Well worth the effort.

Thomas Hsu

I was introduced to Chris by a friend to help me with a cost segregation study. I’m new to real estate investment and Chris was very patient with me, taking the time to walk me through the cost segregation process. He provided a free estimate with various outcomes, conducted a very thorough study, and took the time to walk me through the detailed report. Everything was done timely and professional. I would highly recommend Chris and will partner with him again if I have more real estate investments in the future.

Judah Okeleye

Chris and his staff are extremely professional, knowledgeable, and experienced. His initial estimates were great and the final report was better than those estimates! I highly recommend using Veritax/Chris for your next cost segregation report.

Kevin Kunde

We were referred to Veritax Advisors for a cost segregation report for our short-term rental. Chris and his staff were excellent. They were prompt, professional and fully explained the process and the resulting report. Most importantly, their work likely saved us tens of thousands of dollars in taxes owed to both the IRS and state income tax. Highly recommend their services.

Naila Sharifova

I had the recent pleasure of working with Kevin Miller, cost segregation specialist, and Chris Ostler, the founder of Veritax Advisors. From the moment of original introduction to them to their proposal and final in-person property inspection, delivery of the study, and follow-up meeting with our common client to address any of our questions, I found great professionalism at each level of engagement. Kevin stayed on top of things, was very responsive and organized, and involved Chris when additional tax questions arose. Chris looked at issues from various perspectives, which was beneficial from the cost-benefit scenario, and provided completed 481(a) adj, which is a great plus for me as a CPA. I will happily refer my clients to Veritax Advisors, knowing they will receive top-notch service, and I highly recommend them to my fellow CPAs.

Justin Muller

Chris and his team are very professional and easy to work with. His firm performed a depreciation cost study for one of my investment properties, saving over $100K in taxes in year one. I will use Chris on future projects, and I am happy to recommend him to my fellow real estate investors.

Let’s Connect

Start by scheduling a meeting for a free consultation. Let’s talk about the specialty tax programs that can equate to significant savings.