News You Can’t Afford to Miss

July 2, 2024

MAJOR UPDATE TO FORM 6765 – CREDIT FOR INCREASING RESEARCH ACTIVITIES

The IRS has introduced significant changes to the R&D Tax Credit Form 6765, which will apply to tax years beginning in 2024. The new draft version of the form includes several revisions that will impact how businesses claim and substantiate their R&D tax credits.

June 12, 2024

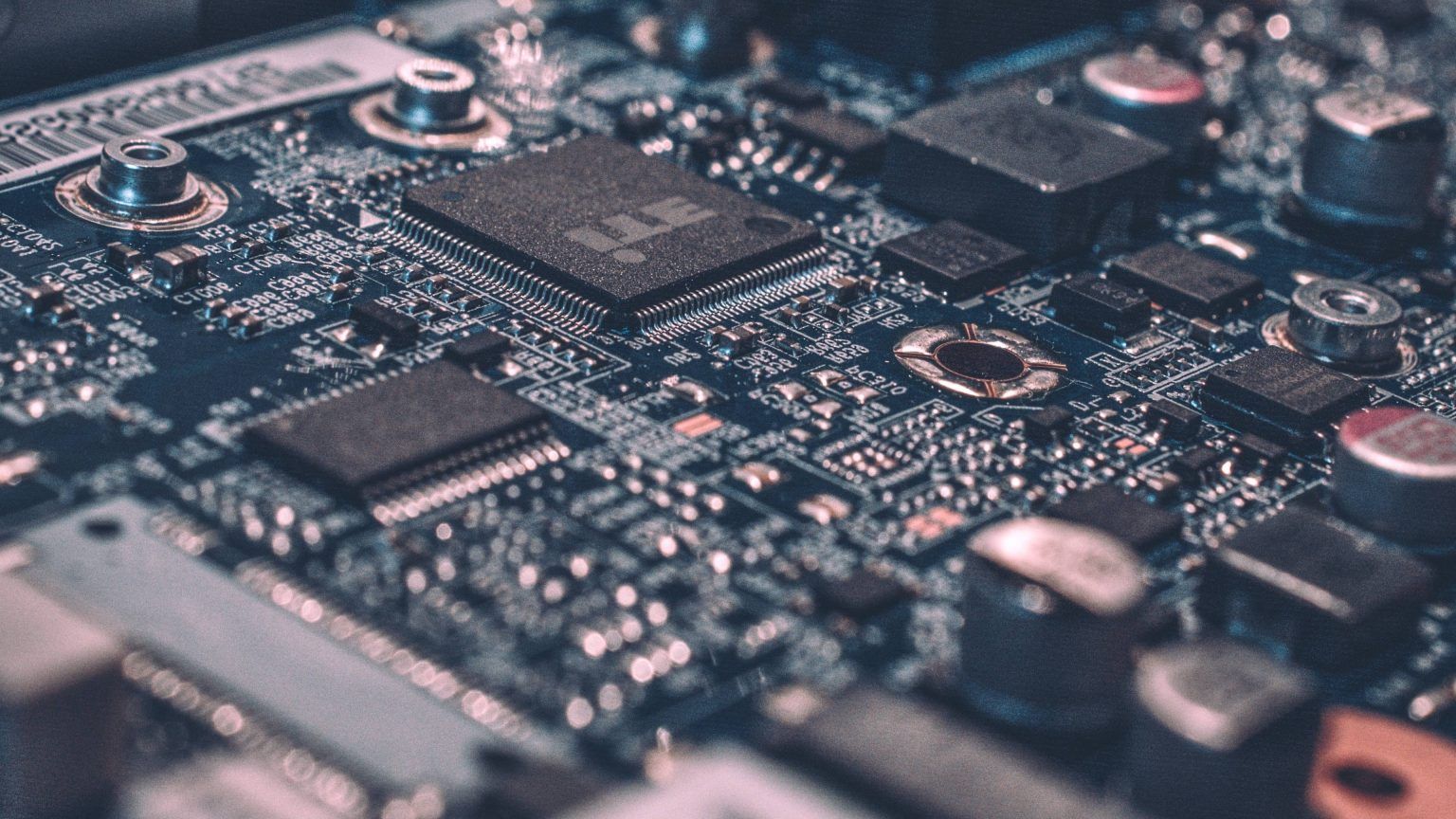

Unleash Innovation, Unleash Savings: R&D Tax Credits for Software Developers

For high-tech software developers, the IRS Federal-Level R&D tax credit isn't just a perk, it's a strategic advantage. Your tireless pursuit of breakthroughs in algorithms, UI/UX, and data science qualifies as research and development, unlocking substantial tax savings for your company.

May 30, 2024

Conducting a 1031 Exchange in the United States and Ensuring Maximum Benefit

When you conduct a 1031 exchange in the United States, you have two primary options for depreciating the property you receive in the exchange. These options are crucial in managing your tax liabilities and maximizing the benefits of the exchange.

May 10, 2024

R&D for Startups: A Comprehensive Guide to Getting Started and Maximizing Cash Flow

Research and development (R&D) is a crucial aspect of any startup. It is the engine that drives innovation and growth, enabling companies to develop new products and services that meet the ever-evolving needs of their customers. However, R&D can be a costly endeavor, and it's essential for startups to manage their cash flow effectively to ensure their survival and long-term success.

April 4, 2024

The Hidden Treasure of Cost Segregation for RV and Mobile Home Park Owners

RV and Mobile Home Park owners can benefit from a cost segregation study on their property.

March 10, 2024

Navigating the IRS Guidelines: Ensuring Best Practices in Cost Segregation Studies

March 7, 2024

Unlocking the Benefits of Cost Segregation for Public Storage Facility Owners

Similar to many other businesses there are significant tax incentives in the self-storage industry. Read on to learn how cost segregation helps!

February 13, 2024

R&D Tax Credit Legislation Changes: What Businesses Need to Know

Stay informed on recent changes to R&D tax credit legislation impacting businesses. Learn what you need to know and how it affects your bottom line. Contact us for expert guidance today.

February 9, 2024

Combining Cost Segregation and 1031 Exchanges: A Powerful, but Nuanced Strategy

Both cost segregation and 1031 exchanges are powerful tax-saving strategies for real estate investors. However, using them together requires careful consideration of the benefits and pitfalls. Here's a breakdown:

January 19, 2024

Can Cost Segregation Offset W-2 Income?

Cost segregation can offset your W-2 income depending on the specific circumstances of your situation.

January 4, 2024

Saving Taxes with a Twist: The Tale of Joe's Cost Segregation and Bonus Depreciation Adventure

Once upon a time in the bustling city of Taxville, there lived a man named Joe who had always been on the lookout for clever ways to save on his taxes. Joe wasn't your average tax-filer; he was a tax-saving enthusiast. One sunny morning in 2023, Joe stumbled upon a remarkable opportunity – a chance to save big on his taxes using cost segregation and the enticing 80% additional first-year depreciation that comes with it.

December 10, 2023

Don't Be a Turkey: Get Your Tax Act Together Before 12/31!

Ah, the end of the year is approaching, and you know what that means – it's time for some good old-fashioned tax planning! Because who doesn't love the thrill of scrambling to find deductions and loopholes in the eleventh hour?

November 15, 2023

The Great Blog Silence of 2023: A Taxing Tale

If you've been wondering why our blog has been quieter than a library on a Saturday night, let me spill the beans.

June 20, 2023

CPAs in Summer: The Beach, BBQs, and 1040-ESs

Explore the unique summer world of CPAs! From beach workdays to BBQ tax talks, learn how these finance pros balance relaxation with 1040-ESs and tax planning.

June 6, 2023

Filing Form 3115 with a Cost Segregation Depreciation Change: A Comprehensive Guide

Cost segregation is a valuable tax strategy that can lead to significant tax savings for real estate owners and investors. It involves breaking down a building into its various components, which can then be depreciated over different time periods.

May 10, 2023

New IRS Form 3115 is Now Required for Applications for Accounting Method Changes

May 10, 2023

BREAKING: The IRS Issues New Administrative Authority Governing Cost Segregation Studies

For the first time in many years, the Internal Revenue Service issued a revised Cost Segregation Audit Technique Guide to assist its Revenue Agents and Field Agents in determining the soundness of cost segregation studies submitted by taxpayers to substantiate accelerated depreciation deductions taken on filed tax returns.

April 25, 2023

R&D Tax Credits for the Beer and Wine Industries

The research and development (R&D) tax credit is a valuable tool for incentivizing innovation and research in many industries, including the beer and wine industry. This credit offers a dollar-for-dollar reduction in federal taxes for eligible research and development expenses, providing significant financial benefits to businesses engaged in these activities.

April 11, 2023

Reducing or Mitigating Tax Liability on Self-Storage Properties with a Cost Segregation Study

Self-storage facilities have become increasingly popular over the past few decades, as people look for ways to store their belongings without having to worry about cluttering up their homes or apartments. For owners of self-storage facilities, there are many financial benefits to be gained through cost segregation.

March 28, 2023

The Value of a Cost Segregation Study and When Not to Get One

As mentioned in part one of this two part series, cost segregation is a very niche and complex strategy. Using a cost segregation study to accelerate depreciation and offset your tax liability (either partially or completely) is a powerful strategy. For many property owners, investing in a study provides great benefit – but this isn’t true for everyone. Cost segregation is not a one size fits all solution, and it doesn’t make sense for every situation.

March 22, 2023

Senate introduces bill to repeal the TCJA 174 R&D Amortization Requirement

Effective January 1st of 2022, as outlined in the Tax Cuts & Jobs Act of 2017, taxpayers can no longer fully deduct their R&D expenses in the year in which they are incurred. Instead, taxpayers must amortize their R&D expenses over five years for domestic R&D.

March 16, 2023

Common Questions About Cost Segregation as a Tax Strategy

Cost segregation is a powerful tax strategy with the potential to save property owners a significant amount of money. Hiring a team to evaluate your property and accelerate depreciation on building components and land improvements can offset a significant portion (if not all) of your tax liability. If the study yields a surplus of deductions, they can be carried forward to future years.

February 28, 2023

Lower Your Effective Tax Rates with Specialty Tax Incentives

Numerous business tax incentives are available to taxpayers for the achievement of economic goals. In general, these tax incentives are combined into one ‘general business credit’ for purposes of determining each credit’s allowance limitation for the tax year. The general business credit that may be used for a given tax year is limited to a tax-based amount.

February 14, 2023

Wineries Experience Major Benefits From Cost Segregation

With the increased popularity of wineries, advancements lead to more tax savings Vineyards and wineries have been in existence for thousands of years. Recently, however, they have become more than a center for manufacturing – they have transitioned into a destination for entertainment and tourism. People travel to a location specifically for wine, they host […]

February 2, 2023

IRS Practice & Procedure Alert: New R&D Capitalization Requirements in Effect for 2022, whether claiming the R&D Tax Credit or not!

IRS Practice & Procedure Alert: New R&D Capitalization Requirements in Effect for 2022, whether claiming the R&D Tax Credit or not!

January 17, 2023

Tax Saving Strategies for Hotel Owners

Using Cost Segregation for a Cash Infusion to Reinvest in Your Hotel Running a successful hotel isn’t as simple as buying a property and renting rooms – although to the general public who frequent hotels, I’m sure that seems like the case. If you own a hotel, you already know the work it takes to […]

January 4, 2023

The Blackbox Guide to Demystifying Regular Depreciation and Bonus Depreciation

Cost Segregation is a highly advantageous tax planning strategy that allows companies and individuals alike who have either constructed, purchased, inherited, expanded or remodeled any kind of income producing commercial real estate to increase cash flow by accelerating depreciation deductions and reducing their federal income taxes. To supplement accelerated depreciation deductions, bonus depreciation is also […]

December 20, 2022

The Black Box for Deciphering 2022 R&D Tax Credit Claims

Taxpayers claiming Federal-level R&D tax credit claims have always found it to be a very onerous and arduous task ever since the inception of this incentive into the Internal Revenue Code back in 1981. However, claiming the Federal-level R&D tax credit just became even more challenging this year effective January 1st of 2022 because of […]

December 7, 2022

Cost Segregation for your Rental Property: Demystifying Tax Benefits for Residential Rentals

Residential real estate probably is not the first property type to come to mind when discussing cost segregation. In fact, there are many misconceptions that exist around residential real estate and tax deductions. It is heavily advertised that commercial properties benefit from cost segregation, but residential properties used for rental activities can benefit as well. […]

November 22, 2022

R&D Tax Credits for the Food Sciences and Bio-Flavoring Industry

The food sciences and bio-flavoring industry continues to invest on a large scale every year to develop healthier food choices that contain: No Trans Fat; No MSG; Reduced Sugar; Reduced Sodium; Gluten Free; No Artificial Flavors; No Artificial Preservative; and No GMOs. These scientific advancements within the food sciences industry are significant for these new […]

October 25, 2022

Use the R&D Credit to Offset Payroll Taxes – Even if you Aren’t Yet Profitable

The R&D credit program was permanently extended as part of the Protecting Americans from Tax Hikes Act of 2015. It contains many significant enhancements starting in 2016, including offsets to the alternative minimum tax and payroll tax for eligible businesses. The R&D credit program is still based on credit-eligible R&D expenses, but payroll tax offsets […]

October 11, 2022

The CHIPS Act Ushers in Next-Level Manufacturing Tax Credits

On August 9th, President Biden signed into law the CHIPS Act of 2022 offering billions of dollars in grants and a generous income tax credit to jump-start semiconductor manufacturing within the United States. The CHIPS Act passed with strong bi-partisan support as a vehicle to bolster semiconductor manufacturing activities within the United States. The CHIPS […]

October 4, 2022

Federal Tax Alert: The IRS Updates Transition Period for the R&D Tax Credit

On Friday, September 30th, the IRS announced that the transition period during which taxpayers are provided 45 days to cure a R&D tax credit claim for refund under Sec. 41 of the Code prior to the IRS’s final determination on the claim has been extended through January 10th of 2024. Taxpayers are still required to […]

September 27, 2022

Discussing Cost Segregation with your CPA

Cost segregation is a powerful tax strategy used by commercial and residential rental property owners to help free up cash flow and mitigate tax liability. It involves a detailed study of your building assets to identify which parts of your property qualify for accelerated depreciation expense. By this point you are probably thinking to yourself […]

September 6, 2022

Cost Segregation for the Cannabis Industry: Keep More of Your Money in Your Pocket

Cannabis conjures up an array of emotions in many people. It has become a very hot topic in the recent past, drawing passion from both sides. With many states legalizing cannabis for both medicinal and recreational use – it is shocking that it’s still not legal at the federal level. With all of the controversy […]

August 23, 2022

The Inflation Reduction Act of 2022 becomes Law with Sweeping Changes affecting Specialty Tax Incentives

On August 16th, the Inflation Reduction Act of 2022 (the “Act”) was signed into law by President Biden. This sweeping Act contains over 300 pages, yet still represents a scaled-back version of President Biden’s former Build Back Better Act from 2021 which was never passed into law. The 2022 Act passed the House by a […]

August 9, 2022

The IRS Issues New Administrative Authority Governing the I.R.C. § 179D deduction for Building Envelope Efficiency

On May 26th of 2022, the Internal Revenue Service’s (the “Service” or the “Service’s”) Large Business and International Practice Unit (“LB&I”) released new administrative authority governing the I.R.C. § 179D deduction for building energy efficiency.

July 26, 2022

Raise the BAR with Veritax Advisors Next-Level TPR Compliance Services

Tangible Property Regulations compliance services are best rendered by an engagement team made up of skilled tax professionals to interpret the latest tax laws and engineers to truly comprehend the building envelope including all its components and systems.

July 12, 2022

The Federal-Level R&D Tax Credit Program remains a top priority on the Hill

The Federal-Level R&D Tax Credit Program (the “Program’) was born out of the Economy Recovery Act of 1981 under the President Reagan Administration over 40 years ago. The Program has been credited to helping the US economy not only come out of our then deep recession of the early 1980’s, but also helped foster enormous growth across diverse industry sectors within the US economy for the last four decades!

Let’s Connect

Start by scheduling a meeting for a free consultation. Let’s talk about the specialty tax programs that can equate to significant savings.